Medicare has a puzzling and outdated set of rewards, structured into insurance policies policies with separate cost-sharing demands that do not exist in contemporary workplace health strategies.

It is earlier time for Congress to update and simplify Medicare’s framework – an undertaking that is even more urgent now simply because of the program’s economic problems. Previous year’s trustees’ report projected the hospital insurance (Hello) have faith in fund — section A – would be depleted in 2026, and there is no rationale to be expecting this year’s update (which is past owing) will present significant enhancement.

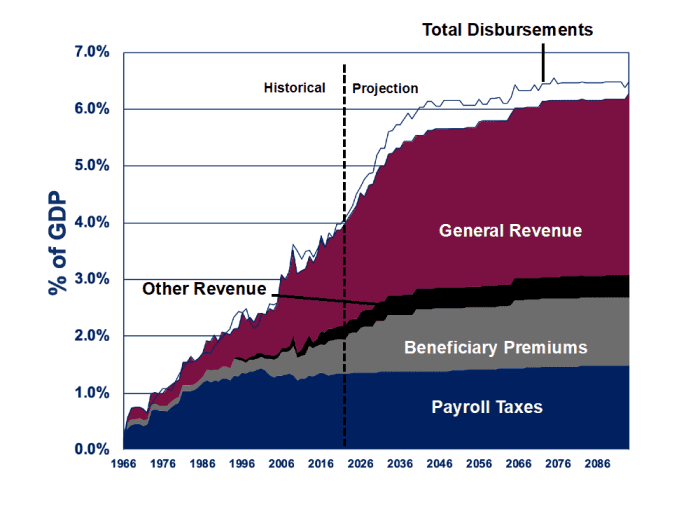

Congress ought to see HI’s troubles as indications of a more substantial difficulty. Hi accounts for only 40% of Medicare investing. The other 60% comes from the Supplementary Clinical Insurance (SMI) believe in fund, covering health practitioner providers, other ambulatory treatment and prescription medicines. Medicare enrollees spend rates set at 25% of SMI expenses the other 75% comes from the federal Treasury (i.e., taxpayers). Over the coming decade, the transfers from the Treasury to SMI are expected to overall $5.3 trillion and develop speedily in the ensuing many years.

Medicare Trustees, 2020 report

Dividing Medicare protection up into numerous parts, with individual value-sharing strategies, may well have designed feeling a half century back, when the non-public sector marketed independent policies for medical professional care and hospitalization, but it no longer does. Now Medicare is a counterproductive combine of required (part A) and voluntary enrollment (components B, for health practitioner visits, and D, for drugs), with additional options to enroll in privately administered Medicare Advantage or Medigap ideas.)

Go through: 5 factors to know about health and fitness treatment in retirement

Interrelated reforms

Medicare can be made more very affordable for taxpayers and understandable for seniors with no compromising protection by means of a collection of interrelated reforms.

The variations ought to begin with modernization and simplification of the gain framework and enrollment method. Beneficiaries really should be offered with the comprehensive array of their gain possibilities by means of one govt-administered enrollment portal. Through it, they must be able to look at the competing offerings on an apples-to-apples basis.

Congress should really combine components A and B into one particular coverage with a one deductible and cost-sharing designed to inspire price tag-efficient use of treatment. There ought to be no coinsurance for inpatient medical center stays, and the cost-sharing need to be adjusted to give all beneficiaries security from significant, yearly out-of-pocket charges (a “catastrophic cap”).

Browse: When should I assert Social Protection? When do I will need to signal up for Medicare?

The actuarial value of this redesigned reward ought to equal what is expected for included advantages in recent Medicare regulation. (This guarantees no increase in federal expenses.)

Implementing this value neutrality necessarily will force the upfront, unified deductible to ranges that may well feel unattractive to the program’s enrollees. However, the distributional consequences would be optimistic, with the sickest beneficiaries receiving aid medical center costs they can’t prevent, together with limitations on their once-a-year out-of-pocket exposure.

Because of its unique design, portion D should remain a individual advantage initially and be integrated into the blended Medicare insurance coverage prepare as high quality support, reviewed down below, is applied for parts A and B.

The Facilities for Medicare and Medicaid Providers (CMS), which administers Medicare, also ought to make it simpler for the program’s beneficiaries to see the quality implications of their coverage solutions. Suitable now, it is not a basic make a difference to examine the all-in costs of enrollment into regular Medicare, with drug protection and Medigap, versus Medicare Advantage plans giving their have version of supplemental rewards.

Next, Congress ought to fork out for Medicare coverage in different ways to foster competitiveness and reduced over-all fees. Medicare Benefit plans should compete from every single other and the classic software, centered on the premiums they charge for normal Medicare added benefits. Medicare would then offer a month to month quality payment dependent on the ordinary cost presenting in every market place. Seniors could decrease their expenditures by enrolling in programs that are the most efficient.

The Congressional Funds Office (CBO) estimates this swap would cut down in general bills by 8% and beneficiary costs by 5%. The price savings could be break up between closing the program’s funding gap and increasing positive aspects.

Seniors also could reduce their expenses if CMS rewarded them for deciding on reduced-priced practitioners. Only about 40% of healthcare treatment is amenable to selling price comparisons in progress of the receipt of expert services, but the opportunity discounts from improved transparency is however substantial.

CMS is already demanding hospital units and physicians to disclose more pricing of their services, but it must go just one action more by eliciting their “all-in” rates for typical definitions of typical and high-priced procedures. Beneficiaries could then share in the cost savings when having products and services with prices below what Medicare would ordinarily fork out.

Medicare is indispensable to its enrollees, and it can be even much more beneficial in the foreseeable future by updating it and making it extra productive. Utilizing the price savings from charge-minimizing reforms would boost Medicare without the need of exacerbating its burden on taxpayers.

James C. Capretta is a senior fellow at the American Enterprise Institute. He is the writer of the report “Market-Driven Medicare Would Established U.S. Health Care on a Greater Program,” published in July by AEI.

Far more on Medicare

Medicare addresses medical center treatment and doctor visits. But did you know it also addresses grief counseling and depression screening?

New to Medicare? How to use the star scores method

You could unwittingly triple your Medicare premiums — here’s what to view for